How to Use UPI to Transfer Funds? Online or Offline

How To Make Online, Offline UPI Payments

According to a report, there are more than 100 million UPI users in India right now. And this number will increase further in the coming days. Google Pay, Phone Pay, Paytm all apps have payment through UPI method only. UPI payment is one of the best ways to do money transactions. Most of the people do UPI or online transactions with the help of internet from their mobiles. But many times we are in a place where there is no internet or mobile network. Due to which we are not able to use UPI payment service.

In view of this problem, Reserve Bank of India and NPCI brought offline UPI payment system. With this, payment can be done without internet also. So let’s know with the help of this article how you can do UPI payments without internet.

What is UPI?

The full name of UPI is Unified Payments Interface. It is an instant money sending payment system. Which is made by NPCI. With the help of which you can send money to whomever you want from your bank account at any time, anywhere. But there is a limit to UPI payment. Also, OTP is not required in UPI payment.

To use the UPI payment system, you must have a bank account and an ATM because in this system money goes directly from your bank account to the other’s bank account. Along with this, your mobile number must be linked with your bank.

How to Use UPI to Transfer Funds?

To make payment through UPI, first of all it has to be activated. You have to create a UPI ID by creating your account in any of its UPI service provider app. After that you can make payment through UPI.

UPI Service Provider Mobile Apps :-

- BHIM UPI

- Google Pay

- Phone Pay

- Paytm

- Mobikwik

- Amazon Pay

- Samsung Pay

- WhatsApp Pay

- Money Transfer

- SBI Pay

In addition there are plenty of options available.

How to Activate UPI Service?

Activating UPI Service is very easy, you just have to install any UPI App in your mobile phone and you have to create a UPI Id on it. Suppose you are creating UPI ID in phonpe, then for this –

- First of all install and open Phonpe on your mobile.

- Now signup by entering name, mobile number. (Remember to signup with the same mobile number to which your bank account is linked)

- Add bank by clicking on add bank after login.

- After this create UPI ID from ATM Card detail.

- An OTP will come to your mobile, fill it.

- Now, a PIN will be generated in it, which can be of 6 digits or 4 digits.

- Always remember this pin, and do not share it with others. It works like OTP.

How to make online payment through UPI –

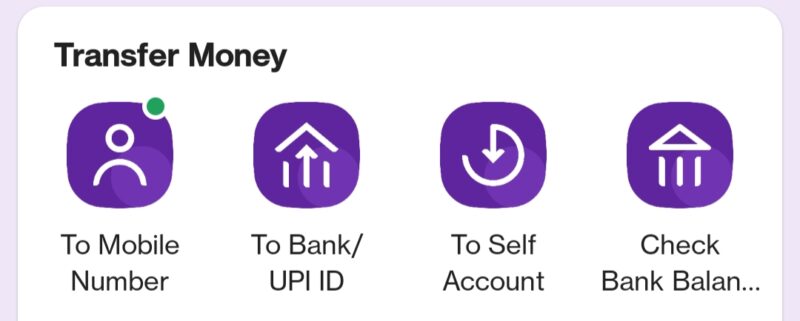

It is very easy to make online payment with UPI. Once the UPI service is activated, you can make payments on any account or mobile number. To make online payment through UPI, first of all, open the UPI app you are using and keep the internet on.

- Here, the option of Mobile to mobile, To Bank, UPI and Scan to Pay will be available.

- Select the option in which you want to send it.

- After this, after entering the details of the money receipt, click on send.

- Here UPI will ask for PIN, after which the money will be gone.

- In this way, you can do online payment transactions using UPI service.

How to make offline payment through UPI? –

To make offline payments through UPI, a one-time UPI ID has to be created in an app. It has been told in detail above. If you already have a UPI ID, then to make offline UPI payment, you need to do a one-time registration by calling the IVR number of NPCI. This process has to be done only once.

For this, you have to call this phone number 0804 5163 666 from your mobile. After the call you will be asked to select your preferred language. After selecting the language, you have to press the number 1 button to transfer money. After that the name of the bank has to be mentioned. Now you will be told about your bank connected to UPI, which has to be done by pressing 1 to confirm.

Now to send money from offline mobile, number 1 has to be pressed. After that enter your mobile number and confirm all the details. Write the amount you want to send on the mobile, then enter the UPI PIN to authorize and complete the transaction. In this way you can use UPI payment transaction service offline without internet.

How to make payment through UPI in offline feature phone? – How to Make UPI Payments Without an Internet Connection

If you have a feature phone and want to make UPI payment from it, then it is also easy. Recently, the Reserve Bank of India (RBI) issued a directive and said that a maximum of Rs 200 can be paid offline at a time through UPI. The total amount of offline payment has been fixed by the Reserve Bank at a maximum of Rs 2000.

To make offline UPI payments from your feature phone, type ‘*99# on your phone. After this you will see a pop-up menu in which you will have to choose the first one i.e. ‘Send Money’ option out of the many options given. Now, there will be several options for sending money, including UPI ID, bank account details and mobile number.

Now if you want to do UPI from mobile number, then select the option of mobile number and enter that number. Now enter the amount you want to send and hit the send button. Write a remark about the payment. Enter the UPI PIN to complete the transaction. Your transaction will be successful without any internet connection.

Benefits of using UPI service

UPI is this new age payment transaction service. Which can be done very easily. OTP is not required in this and is also transferred immediately. With this, now offline UPI service has come, which makes it easier. *99#The service is currently offered by 83 leading banks and all GSM service providers and can be accessed in 13 different languages including Hindi and English.

FAQs

What does UPI mean?

The full name of UPI is Unified Payments Interface. It is an instant money sending payment system.

What is UPI and its benefits?

UPI or Unified Payments Interface is a digital payment system that allows different bank accounts to be used using a single mobile application. With this, you can do money transactions easily.

How to get UPI PIN?

You can create UPI PIN from your mobile. Simply, for this you must have a bank account, ATM and mobile number registered.

What is the difference between UPI and Net Banking?

In UPI, In net banking you have to fill all details.

Also, Read More:-